US Taxation Form 1040 - Individuals

8 Weeks

8 Weeks

Understanding Form 1040 is essential for anyone entering US taxation. This module offers a foundational understanding of personal income tax principles, equipping learners with practical skills for tax preparation and filing. It's crucial for professional growth in finance and accounting, opening doors to diverse career opportunities.

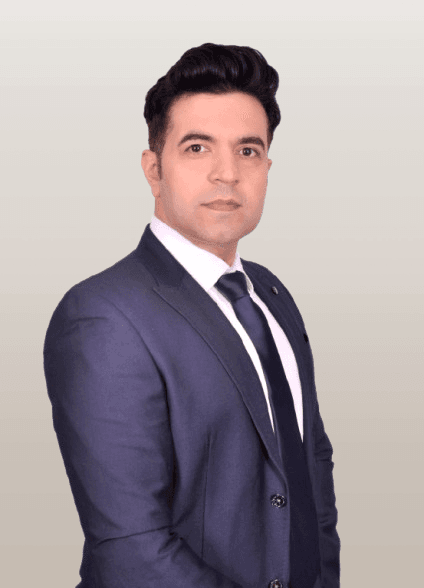

US CPA–led instruction

Practical Form 1040 training

Real IRS forms used

Current IRS regulations covered

Job-ready tax skills

Global career relevance

Step-by-step filing approach

Error-free preparation focus

Hands-on learning model

Industry-aligned curriculum

Expert tax mentors

Professional certification value

High-demand US tax skills

Trusted learning platform

Hear directly from our students about how BOARD360 has transformed their careers and helped them achieve their professional goals.

Form 1120 used to be a mystery, but Board360's module demystified it completely. Their Form 1120 module was a game-changer for both my friend and me. What truly sets it apart is the real-based examples and step-by-step practical tax preparation training, including hands-on experience with tax software. It genuinely helped me build the specific skills that are in high demand in the US taxation industry. Sagar Bajaj Sir is an amazing teacher. I owe a huge thanks to Board360 and Sagar Bajaj Sir for his exceptional teaching and guidance.

My experience with Board360’s Form 1040 training course has been truly outstanding. The course was not only well-structured but also incredibly practical, helping me understand the nuances of U.S. individual tax filing with clarity. Learning from Sagar Bajaj Sir was a privilege. His deep knowledge, step-by-step teaching style, and real-life examples made even the most complex IRS concepts easy to grasp. His passion for teaching and focus on practical application gave me the confidence to handle real tax scenarios with ease. I’m extremely grateful to Board360 and Sagar Sir for delivering such high-quality, career-oriented training.

I recently completed the US Tax Training program by Board 360.ai, and it has been a truly enriching experience. The course provided deep technical coverage of critical areas such as Form 1120 (Corporations), and 1040 (Individuals) — with practical insights into GILTI, FTC, BEAT, and international tax compliance. Sagar Bajaj had covered all the relevant schedules A to F in form 1040 with the real life Client Exposure whether it's 1120, 1040 or 1040NR Inclusively covered topics on Industry Relevant Drake Software which helped to gain tax technical knowledge. This program covers from preparation to E-filling you will become expert in problem solvers and help your clients and there will be a bright future if we want to join an industry or CPA Firm in India.

The U.S. Taxation classes by CPA Sagar Bajaj at Board360 were a turning point in my career. He not only made complex topics easy to understand but also guided me throughout and even after the course. His mentorship opened the door to my success in U.S. Taxation. I truly owe a lot to CPA Sagar Bajaj for helping me get started with confidence and clarity.

Hi, I’m Sejal. I enrolled in the Enrolled Agent course at Board360, and it has been an excellent experience. The course is well-structured with a strong focus on practical learning, especially related to U.S. tax laws and IRS procedures. Sagar Sir and the entire faculty explained complex topics in a very clear and simple manner. They were always available to resolve doubts and provide guidance whenever needed. Their continuous support has boosted my confidence to clear all three EA exams and advance further in my tax career.

This program gave me practical skills I could immediately apply. Filing Form 1040 no longer feels intimidating.

We don't just teach tax theory – we train future-ready professionals in US individual taxation. Learn the intricacies of personal income tax principles, preparation, and filing using real forms, professional tools, and practical case studies. Whether you're a fresher or a working professional, mastering Form 1040 is your launchpad to global tax careers.

Work on actual IRS Form 1040 examples, not just theory. Apply concepts to real-world cases.

Curriculum aligned with high-demand US individual taxation roles at Big 4 firms, MNCs, and outsourcing companies. Get job-ready for hybrid and remote opportunities.

Benefit from interactive live sessions with experienced US taxation professionals.

Train using industry-standard US tax preparation software to build practical proficiency.

Each module is sharp, streamlined, and focused on what employers truly value in individual taxation specialists.

Learn at your own pace with access to eBooks, recorded video lessons, and presentations for self-paced study.

Prepare for a career in US individual taxation with skills that open doors to freelance, remote work, and roles with global tax firms.

Mastering Form 1040 is essential for anyone aiming to excel in US personal income tax. This module provides a strong foundation and practical skills for accurate tax preparation and filing.

Key principles of US personal income tax

Practical skills for tax preparation and filing

Overview of IRS forms and documentation requirements

(Includes live sessions, case studies, and a final assessment.)

Tax Preparer / Consultant

CPA or Accounting Professional specializing in US taxation

Payroll & HR Tax Specialist

Corporate Accountant / Finance Professional

International Accountant or Freelance Tax Advisor

Career advancement in multinational companies

Step into real U.S. tax practice with our Form 1040 Demo Certificate— an authentic preview of the individual income tax return you’ll be fully equipped to prepare after completing the program.

Free Demo Class

Gain hands-on expertise in Form 1040, individual deductions, and U.S. tax Drake software. Build job-ready skills that prepare you for global roles in taxation and compliance.

Understand foundational principles of personal income tax and how to accurately prepare and file a complete Form 1040.

Ability to apply tax rules to real client scenarios , including income types, deductions, and tax credits.

Familiarity with tax software and compliance workflows through live demonstrations using professional U.S. tax preparation tools.

Job-ready skills. Real-world training. Global tax careers start here.

Course Structure & Assessment Format

| Component | Details |

|---|---|

| Mode of Learning | Live + Self-paced via LMS |

| Study Materials | eBooks, recorded sessions, presentations, end-of-module assessments |

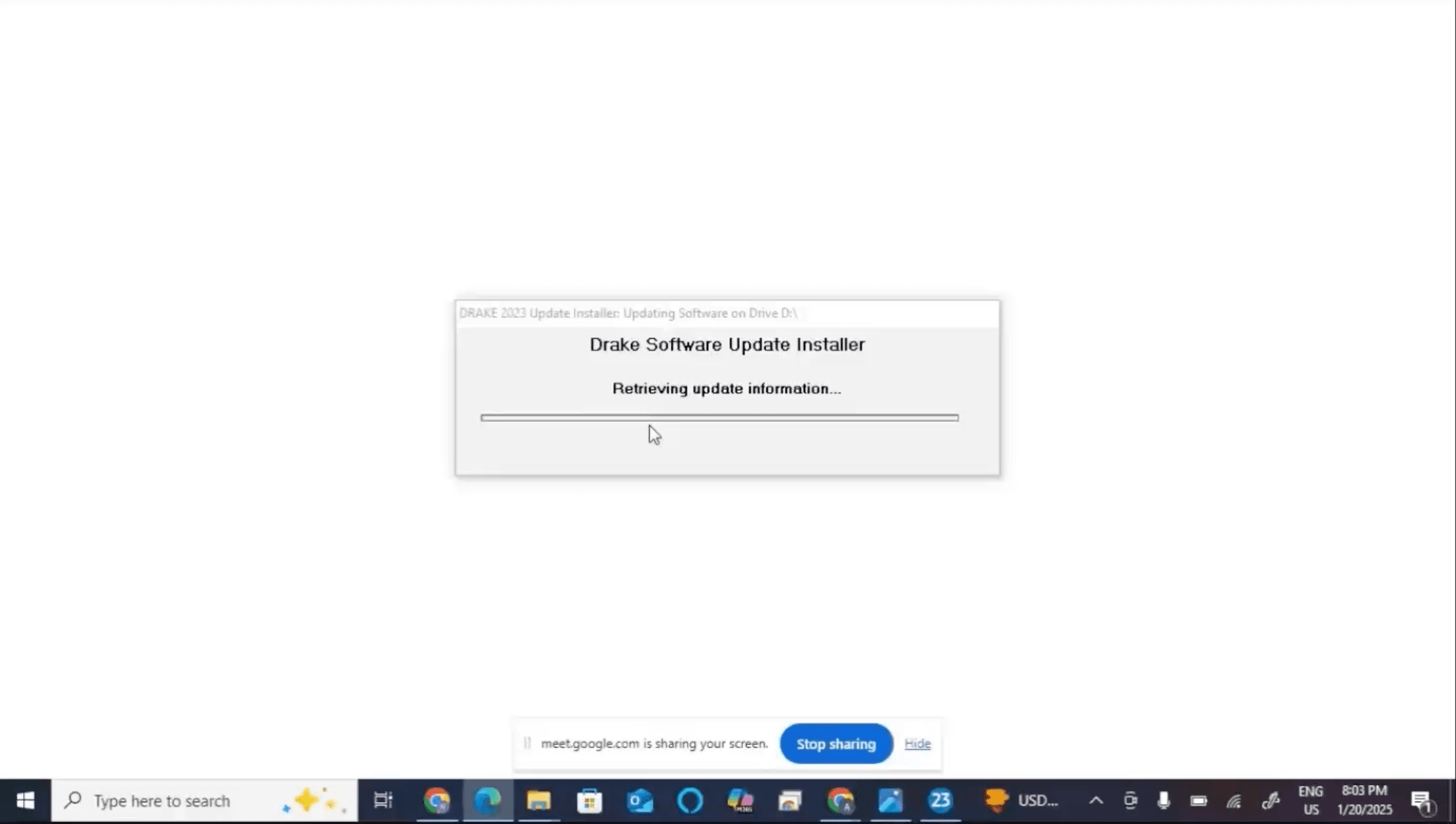

| Practical Training | Hands-on training on Drake tax software, real-world case studies |

| Final Assessment | End-of-program assessment to evaluate knowledge and readiness |

| Certification | Issued by Board360 in collaboration with industry experts and CPA firms |

Core Concepts of Individual Taxation (Form 1040)

Understanding Form 1040 is foundational for US individual taxation. This module offers a comprehensive grasp of personal income tax principles, covering various income types (wages, interest, dividends, self-employment), determining filing status and dependents, and distinguishing between standard and itemized deductions. You will also delve into essential tax credits like education, child care, and earned income credit, along with the calculation of taxable income and tax liability. The section also covers tax filing deadlines, extension procedures, and an introduction to key IRS forms and documentation requirements.

In-Depth Form 1040 Preparation

This core section provides a guided walkthrough of preparing and filing a complete Form 1040. You will engage in live demonstrations using professional tax preparation software, gaining practical experience in navigating the forms and ensuring accuracy. The module emphasizes hands-on practice through exercises based on real-world case studies, allowing you to apply tax rules to diverse client scenarios. This practical approach ensures proficiency in preparing and reviewing Form 1040, equipping you with the skills needed for real-world tax preparation tasks.

Practical Application & Software Proficiency

Beyond theoretical knowledge, this module focuses on the practical application of tax rules and developing proficiency with industry-standard tax software. You will learn how to apply complex tax rules to various individual scenarios, ensuring compliance and accuracy. The hands-on training includes using professional tax preparation tools, which is crucial for modern tax professionals. This experience will make you familiar with tax software and compliance workflows, giving you a competitive edge in the job market whether you're working in firms or as a freelancer.

Outcomes & Career Readiness

Upon completion of the Form 1040 module, you will achieve proficiency in preparing and reviewing Form 1040, along with the ability to apply tax rules to real client scenarios. You will also gain familiarity with tax software and compliance workflows, making you job-ready for roles such as US Tax Associate/Analyst at Big 4 firms and MNCs, Tax Preparer/Reviewer in outsourcing and consulting firms, or a freelance US tax preparer during tax seasons. This program is designed to strengthen your profile for global opportunities and open doors to freelance or remote work in the US tax domain.

Program Director | Board360

eBooks, video sessions, presentations, and end-of-module assessments to evaluate your learning.

Online sessions, including hands-on training on tax software and a dedicated doubt-clearing session before your final assessment.

Issued by Board360, in collaboration with industry experts and channel partners (CPA firms).

Understand foundational US individual taxation principles, including types of income, filing status, and dependents.

Delve into standard vs itemized deductions, various tax credits, and the calculation of taxable income and tax liability.

Engage in guided walkthroughs of preparing and filing Form 1040, live software demonstrations, practice exercises, and introduction to IRS forms and documentation.

What is US Form 1040?

When should I file Form 1040?

Who needs to file Form 1040?

What information does Form 1040 include?

What if I filed the wrong information?